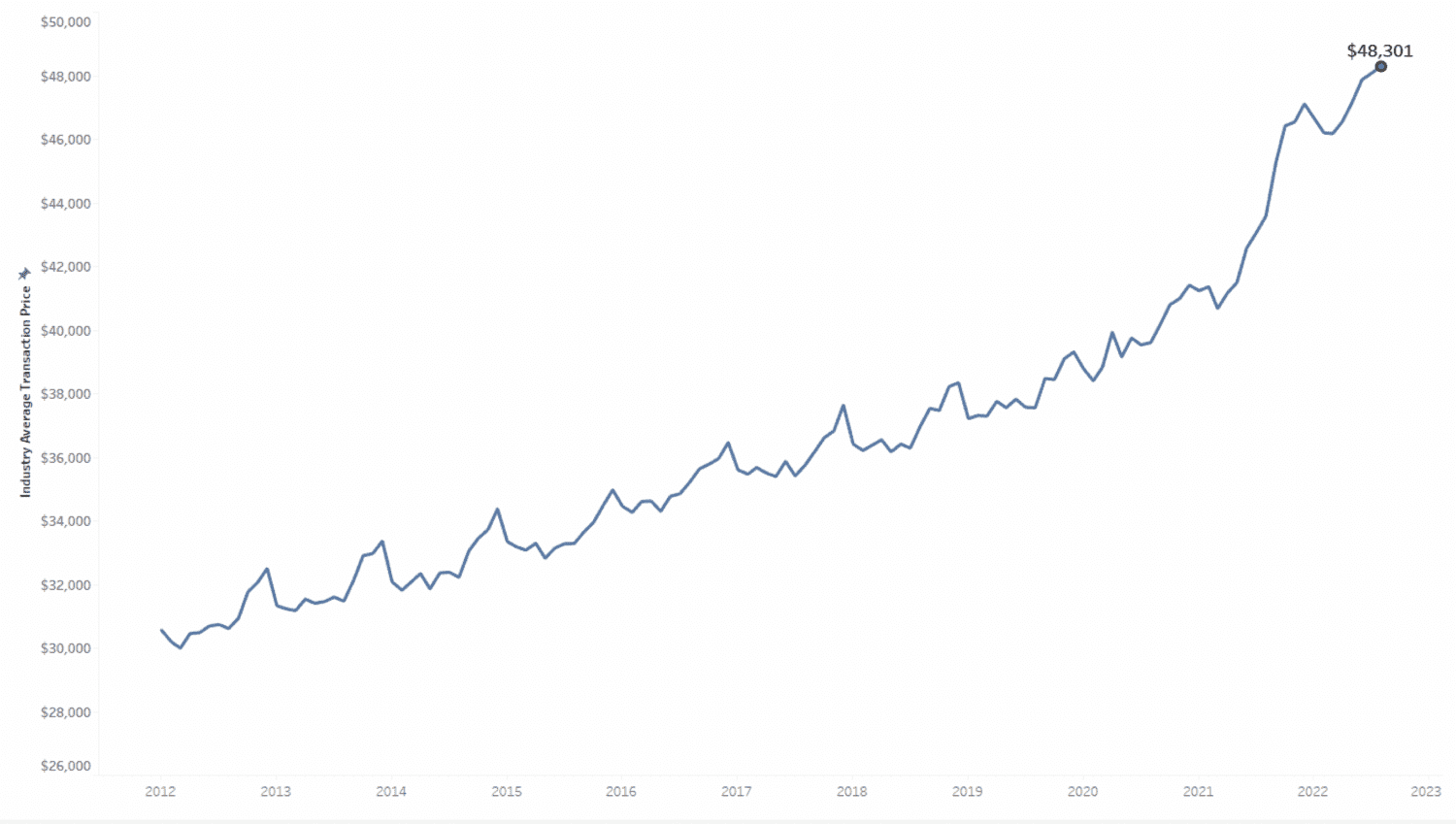

Along with the heightened auto mortgage price and reasonable transaction fee, which used to be at $48,301 as of August 2022, the estimated standard per month fee has risen 1.4% to $743. A vital leap from $575 on the similar time closing 12 months.

Listed here are the entire techniques loss of car affordability and rate of interest will increase are impacting automobile patrons:

Contents

Longer mortgage lengths

In accordance to the Client Monetary Coverage Bureau (CFPB), the pointy fee build up has brought about attainable automobile patrons to extend the period of loans they take out for vehicles. All classes of debtors (top, near-prime, subprime, and deep subprime) noticed an build up in mortgage lengths, with each near-prime and top edging nearer to 70 months.

This building will have far-reaching results, as automobile homeowners will in the end pay extra passion through the years. If per month bills stay prime, automobile patrons may have an extended time to handle this quantity if there’s a monetary pressure. This case may just result in extra of the next adverse have an effect on coated within the subsequent segment.

Delinquencies are emerging

Any other worrisome pattern is that the selection of auto mortgage delinquencies is emerging. Of their document, the CFPB discovered that delinquencies for loans that originated in 2021 had been 13% upper than auto loans that automobile patrons took out in 2018. Sadly, those charges had been even upper for debtors with subprime and deep subprime credit score rankings.

Due to this fact, people who would possibly already be at the monetary fringes will have a good more difficult time maintaining their mortgage bills. Couple this with longer auto mortgage phrases and prime per month charges and a few automobile patrons may well be priced out of vehicle possession.

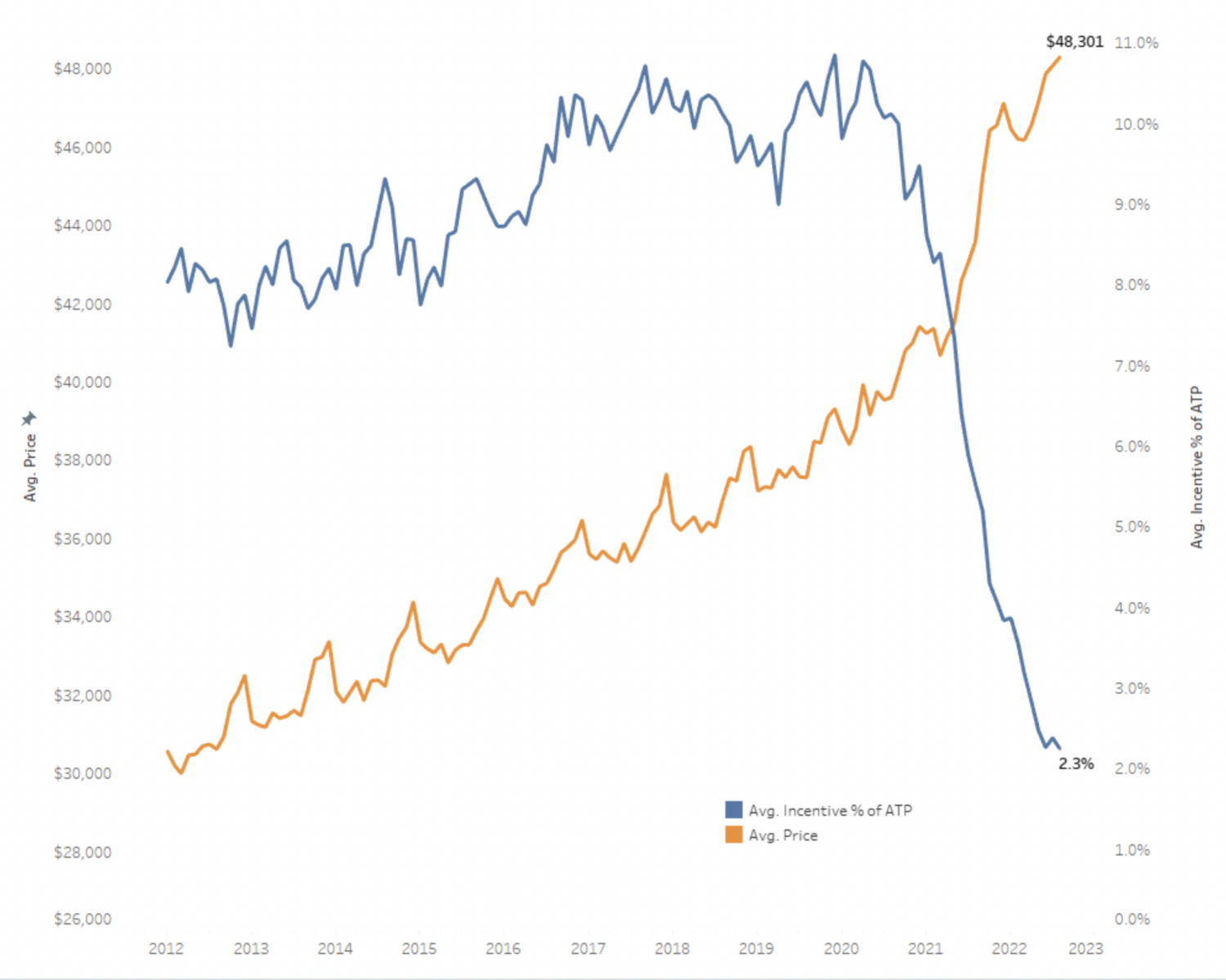

Reductions are scarce

Normally shoppers can depend on some reductions or financial savings once they paintings with sellers to get a brand new or used automobile. Then again, it can be some time ahead of some sellers start to be offering incentives on a much broader scale. In keeping with a New York Occasions article, whilst the provision of latest and used cars is rising, many sellers nonetheless really feel that there’s unmet call for, which may well be sidelining any want for reductions.

It sort of feels as though the used automobile marketplace is rebounding and that call for and provide are returning to commonplace. But, this isn’t the case for brand spanking new cars. Due to this fact, there is usually a little bit of a divide between automobile patrons in search of used vehicles and the ones available in the market for brand spanking new cars, as indicated on this New York Occasions article:

“The central financial institution has been lifting borrowing prices on the quickest clip because the Nineteen Eighties. As financing a automobile acquire turns into costlier, price-sensitive auto consumers within the used marketplace would possibly start to pull again extra significantly, forcing used-car sellers to rate much less.

New vehicles is also a unique tale, on the other hand, as a result of provide and insist stay so out of whack.”

What may just this imply for the trade?

The lower in car affordability may have a vital have an effect on at the person. Everybody will most probably really feel the finances pressure of buying a brand new car. Then again, new and extra just lately used fashions is also out of succeed in for plenty of heart and lower-class automobile patrons having a look to possess a car.

In the long run, those trends will most probably transfer them towards extra reasonably priced used vehicles, lowering the selection of shoppers open to new vehicles. General, this is able to trade the entirety from how reductions are introduced to even how sellers goal attainable automobile patrons within the close to and long run.

Did you experience this text? Please percentage your ideas, feedback, or questions relating to this subject by means of connecting with us at newsroom@cbtnews.com.

Supply By way of https://www.cbtnews.com/how-declining-new-vehicle-affordability-is-rattling-consumer-budgets/